Gold Terra Announces a 2 Year Extension on Option Agreement with Newmont to November 21st, 2027 to purchase 100% of Past Producing 16 g/t Gold Con Mine, Yellowknife, NWT

9 September 2024

VANCOUVER, BC / ACCESSWIRE / September 9, 2024 / Gold Terra Resource Corp. (TSX-V:YGT)(Frankfurt:TX0)(OTCQX:YGTFF) ("Gold Terra" or the "Company") is pleased to announce it has extended its four (4) year definitive option agreement (the "Option Agreement") with Newmont Canada FN Holdings ULC ("Newmont FN") and Miramar Northern Mining Ltd. ("MNML"), both wholly owned subsidiaries of Newmont Corporation ("Newmont"), to a six (6) year agreement which grants Gold Terra the option, upon meeting certain minimum requirements, to purchase MNML from Newmont FN (the "Transaction"), which includes 100% of all the assets, mineral leases, Crown mineral claims, and surface rights comprising the Con Mine, as well as the areas immediately adjacent to the Con Mine, as shown in Exhibit A (the "Con Mine Property").

Gerald Panneton, Chairman & CEO of Gold Terra, commented, "We are pleased with our continued excellent relationship with Newmont who is also a shareholder of the Company. The extension of the Option Agreement to acquire 100% of MNML's Con Mine allows us to continue with our current drilling program designed to delineate more than 1.5 Moz in all categories with high-grade ounces along the prolific Campbell Shear structure below and around the existing mine workings. Our accomplishments to date include:

-

Contained Indicated 109,000 ounces @ 7.55 g/t Au and Inferred 432,000 ounces @ 6.74 g/t Au near surface south of the Con Mine in the Yellorex area. (refer to Gold Terra Oct 21, 2022, Technical Report).

-

Total drilling of 31,947 metres to the end of 2023.

-

Total spending of approximately C$10.9 million to the end of 2023

-

Current 2024 drilling of more than 3,000 metres testing the down plunge of the Campbell shear.

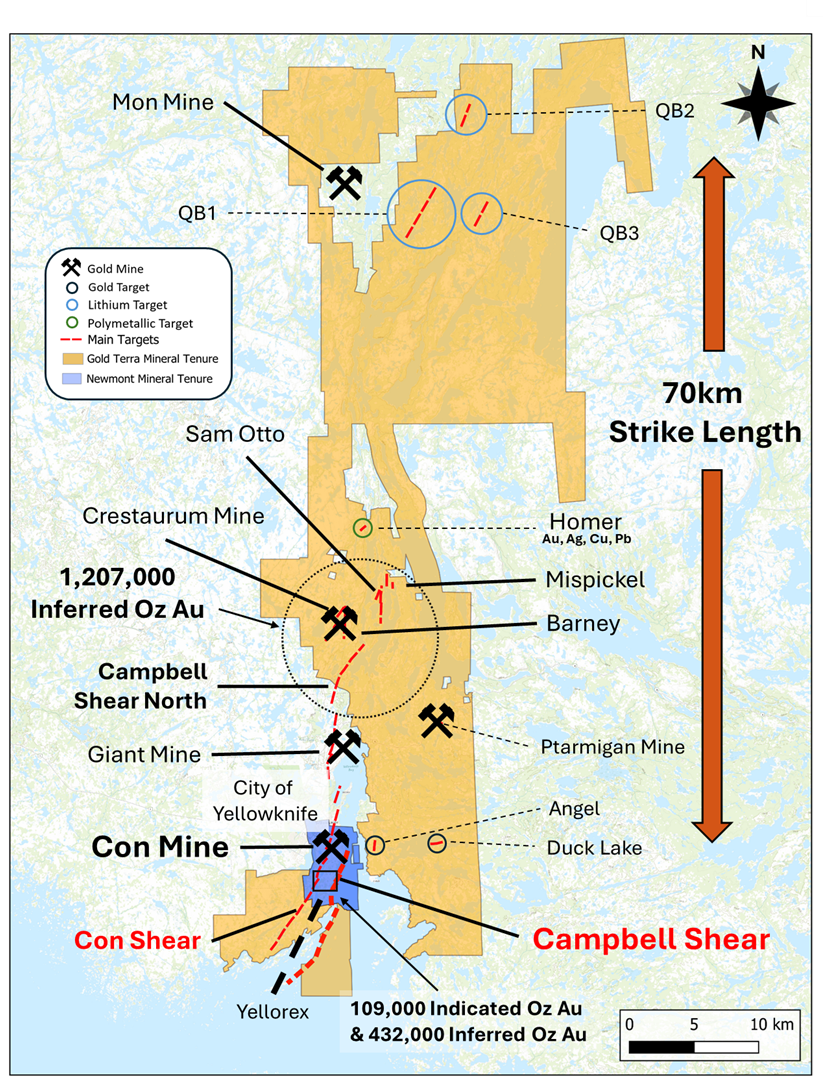

The extended Option Agreement to six (6) years provides the Company more time to complete its evaluation before exercising its option to purchase 100% of MNML, the owner of the past-producing Con Mine, which produced more than 6.1 Moz (averaging 16 to 20 g/t Au) along the Campbell and Con Shear structures. Completion of the Option Agreement will consolidate the Company's strategic land position in the prolific Yellowknife Gold Belt (shown in Figure 1 below) and provide potential future development optionality. The former Con Mine is a world-class gold deposit and part of the prolific Yellowknife mining camp. (refer to Gold Terra Oct 21, 2022, Technical Report).

Figure 1: Con Mine Option Location

Option Agreement Highlights:

-

Execution of the 2021 Option Agreement to include all (100%) of MNML and the Con Mine Property (November 22, 2021 press release).

-

The Option Agreement has now been extended whereby in order to retain the Earn-In Right and earn the Purchase Option, Gold Terra must, within six (6) years following the Effective Date complete the Earn-In specifications.

-

Gold Terra has agreed to incur a minimum of C$8.0 million in exploration expenditures over a period of six (6) years, which will include all exploration expenditures incurred to date under the initial Exploration Agreement.

-

Gold Terra has also agreed to:

-

Complete a Pre-Feasibility Study (PFS) of a mineral resource and a minimum of 1.5 Moz in all categories,

-

Obtain all necessary regulatory approvals for the purchase and transfer of MNML's assets and liabilities to Gold Terra,

-

Post a cash bond to reflect the status of the Con Mine reclamation plan at the time of closing.

-

The closing of the Transaction will then be completed with Gold Terra making a final cash payment of C$8,000,000.

Newmont will retain a 2% net smelter returns royalty (the "NSR") on minerals produced from the Con Mine Property. The NSR may be reduced by 50% by the Company paying Newmont the sum of C$10,000,000, for a period of two (2) years following the annoucement of commercial production.

After Gold Terra exercises its option, Newmont will have a period of two (2) years to exercise its one time back-in right of a 51% participating interest in MNML and the Con Mine Property, which can be triggered by Gold Terra delineating a minimum of five (5) million ounces of gold in the measured and indicated mineral resource categories supported by a National Instrument NI 43-101 technical report. If Newmont exercise its one time only back-in right, it will have to reimburse Gold Terra 3 times its exploration expenditure to that date, and also pay US$ 30 per once on 51% of all the ounces delineated in the latest 43-101 report

Substantial Benefits To UNLOCK

Upon exercise of the option, Gold Terra would have substantial benefit from owning 100% of the Con Mine Property including:

-

Mineral leases and overlying surface rights.

-

Access to infrastructure, including underground openings and shafts, buildings, storage facilities and roads. The hard assets include the original C -1 shaft opening, and the deep Robertson shaft (1,950 metres) with a 2,000 tpd (ton per day) capacity for future underground exploration and mining, valued for time and investment saving; surface infrastructure including a large 10,000 square foot warehouse and dry; surface vehicles; and a 2015 C$20 M water treatment plant . These assets provide substantial future cost savings for potential development.

-

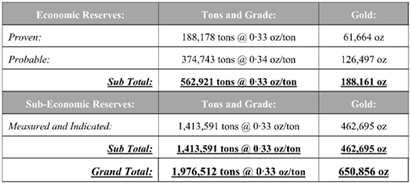

Access to explore and potentially redevelop the remaining historic mineral reserves within the Con Mine Property. The Con Mine was shut down in 2003 following multiple years of low gold prices. Historically, a total of 6.1 Moz of high-grade gold were recovered from the underground Con Mine operation. Remaining historic sub-economic reserves based on a US$370/oz gold price at the Con Mine as of January 1, 2003, are shown in the following table:

Table 1: Historic Reserves as of January 1, 2003* (Source: Miramar Mining Corp Limited 2003)

*Note: The Historic Reserves and Resources quoted above are historical in nature and are not NI 43-101 compliant. They were compiled and reported by MNML during its operation and closure of the Con Mine (2003). The historical estimates are historical in nature and should not be relied upon, however, they do give indications of mineralization on the property. The Qualified Person has not done sufficient work to classify them as current Mineral Resources or Mineral Reserves and Gold Terra is not treating the historical estimates as current Mineral Resources or Mineral Reserves. (See Oct. 21, 2022 Technical Report)

Con Mine Option Property Deep Drilling Program

The objective of the upcoming Phase 2 drilling program is to continue testing for high-grade gold in the Campbell Shear (past production of 5.1 Moz @ 16 g/t, refer to the Oct. 21, 2022 Technical Report) on the Con Mine below the historic Con Mine underground workingsfrom the recently completed master hole GTCM24-056. Hole GTCM24-056 was drilled to a depth of 3,002 metres and will serve as a master hole from which to branch off with as many wedges as possible to evaluate the Campbell Shear in a first phase of wedge drilling from 600 metres to 700 metres below the current Robertson shaft depth, up-dip and laterally. The branching-off wedge drilling strategy from the same master hole will allow for the evaluation of the Campbell Shear with shorter and lower cost holes.

The 2024 deep drilling program aims to expand the September 2022 initial Mineral Resource Estimate ("MRE") (see September 7, 2022, press release) of 109,000 Indicated ounces of contained gold and 432,000 Inferred ounces of contained gold between surface and 400 metres below surface along a 2-kilometre corridor of the Campbell Shear (October 21, 2022 MRE titled "Initial Mineral Resource Estimate for the CMO Property, Yellowknife City Gold Project, Yellowknife, Northwest Territories, Canada") by Qualified Person, Allan Armitage, Ph. D., P. Geo., SGS Geological Services, which can be found on the Company's website athttps://www.goldterracorp.comand on SEDAR at www.sedar.com.

The technical information contained in this news release has been reviewed and approved by Joseph Campbell, Chief Operating Officer, a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Corporate Update

The Company is pleased to announce the engagement of David Sears, DS Market Solutions Inc. (DS), to provide the Company with capital markets advisory and market-making services. DS will trade the securities of the Company on the TSXV for the purpose of maintaining an orderly market "in compliance with the provisions of TSXV Policy 3.4". In consideration of the services provided by DS, the Company will pay DS a monthly fee of $5,000 for a minimum term of one month and renewable for successive one-month terms thereafter. Either Party may terminate the arrangement by providing written notice to that effect 30 days prior to the end of the then current term. The services provided by DS commenced on July 2, 2024.

DS is an equity trading advisor to issuers looking to enhance liquidity in their public traded securities. DS was incorporated in Mississauga, Ontario in April 2024 and the offices of DS are located in Mississauga, Ontario. Mr. David Sears is the sole owner of DS and will be providing the services on behalf of DS. DS Market's contact is davidsears@dsmarketsolutions.com.

Town Hall Meeting with Drilling Update

The Company is pleased to announce that it will host a Town Hall Meeting on October 1st, 2024, at 5:30pm MDT at the Yellowknife Historical Society Museum, #510 Access Road, Yellowknife.

Gerald Panneton, Chairman & CEO, will provide shareholders and interested investors an update on the drilling program and answer any questions that investors may have regarding the Company's vision and exploration plans for the upcoming year.